Madison County Arkansas Personal Property Tax . Search arkansas assessor and collector records online from the comfort of your home. Assess your personal and business property between january 1st and may 31st of each year to avoid a 10% penalty. Search tax records / receipts. The collector in this county has sponsored a free to. Taxes on real estate and tangible personal property are ad valorem. Pay madison county taxes online. The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Click next to pay your personal property and real estate taxes in madison county, arkansas. Online payments are available for.

from diaocthongthai.com

Taxes on real estate and tangible personal property are ad valorem. Assess your personal and business property between january 1st and may 31st of each year to avoid a 10% penalty. The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. Search arkansas assessor and collector records online from the comfort of your home. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Online payments are available for. Pay madison county taxes online. Search tax records / receipts. The collector in this county has sponsored a free to. Click next to pay your personal property and real estate taxes in madison county, arkansas.

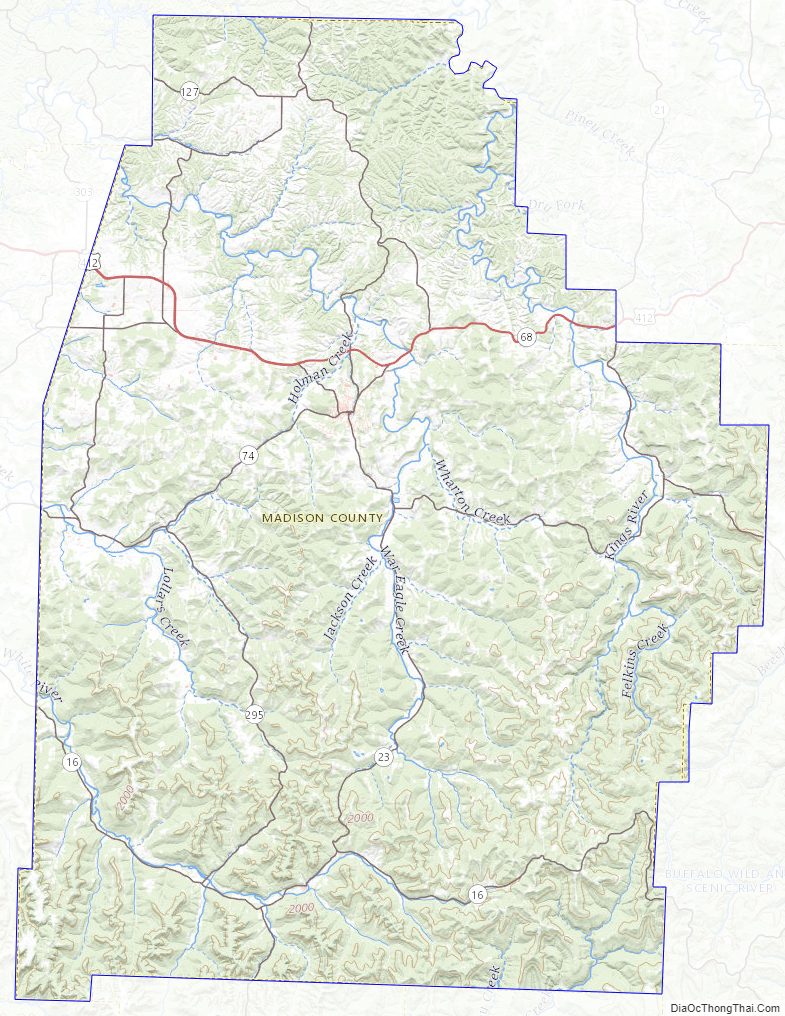

Map of Madison County, Arkansas

Madison County Arkansas Personal Property Tax Search tax records / receipts. Online payments are available for. Pay madison county taxes online. Click next to pay your personal property and real estate taxes in madison county, arkansas. Taxes on real estate and tangible personal property are ad valorem. The collector in this county has sponsored a free to. Assess your personal and business property between january 1st and may 31st of each year to avoid a 10% penalty. Search arkansas assessor and collector records online from the comfort of your home. Search tax records / receipts. The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county.

From www.uaex.uada.edu

What Are These Voluntary Property Taxes On My Bill? Madison County Arkansas Personal Property Tax Search tax records / receipts. Click next to pay your personal property and real estate taxes in madison county, arkansas. Assess your personal and business property between january 1st and may 31st of each year to avoid a 10% penalty. The collector in this county has sponsored a free to. The collector's office is responsible for collecting real estate and. Madison County Arkansas Personal Property Tax.

From www.shutterstock.com

Large Detailed Map Madison County Arkansas Stock Vector (Royalty Free Madison County Arkansas Personal Property Tax Pay madison county taxes online. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. Online payments are available for. Search tax records / receipts. Search arkansas assessor and collector records. Madison County Arkansas Personal Property Tax.

From poppyursala.pages.dev

Arkansas State Tax Rates For 2024 Reeta Celestia Madison County Arkansas Personal Property Tax Click next to pay your personal property and real estate taxes in madison county, arkansas. Assess your personal and business property between january 1st and may 31st of each year to avoid a 10% penalty. Pay madison county taxes online. Search arkansas assessor and collector records online from the comfort of your home. The collector in this county has sponsored. Madison County Arkansas Personal Property Tax.

From diaocthongthai.com

Map of Madison County, Arkansas Madison County Arkansas Personal Property Tax Taxes on real estate and tangible personal property are ad valorem. Pay madison county taxes online. Search arkansas assessor and collector records online from the comfort of your home. The collector in this county has sponsored a free to. Online payments are available for. Search tax records / receipts. Click next to pay your personal property and real estate taxes. Madison County Arkansas Personal Property Tax.

From www.thv11.com

Why we pay personal property taxes in Arkansas Madison County Arkansas Personal Property Tax Search arkansas assessor and collector records online from the comfort of your home. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. The collector in this county has sponsored a free to. Taxes on real estate and tangible personal property are ad valorem. Assess your personal and business property. Madison County Arkansas Personal Property Tax.

From www.thv11.com

Why we pay personal property taxes in Arkansas Madison County Arkansas Personal Property Tax The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Taxes on real estate and tangible personal property are ad valorem. Online payments are available for. Search arkansas assessor and collector records online from the comfort of your home. The collector in this county has sponsored a free to. Pay. Madison County Arkansas Personal Property Tax.

From www.youtube.com

Arkansas Property Taxes YouTube Madison County Arkansas Personal Property Tax Taxes on real estate and tangible personal property are ad valorem. The collector in this county has sponsored a free to. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Assess your personal and business property between january 1st and may 31st of each year to avoid a 10%. Madison County Arkansas Personal Property Tax.

From www.land.com

20 acres in Madison County, Arkansas Madison County Arkansas Personal Property Tax The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. The collector in this county has sponsored a free to. Online payments are available for. Click next to pay your personal property and real estate taxes in madison county, arkansas. Search arkansas assessor and collector records online from the comfort of. Madison County Arkansas Personal Property Tax.

From printableformsfree.com

Arkansas Individual Tax Forms Free Fillable Printable Forms Madison County Arkansas Personal Property Tax Search arkansas assessor and collector records online from the comfort of your home. Click next to pay your personal property and real estate taxes in madison county, arkansas. The collector in this county has sponsored a free to. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. The madison. Madison County Arkansas Personal Property Tax.

From blog.al.com

Madison County adopts new commission districts to reflect population Madison County Arkansas Personal Property Tax Assess your personal and business property between january 1st and may 31st of each year to avoid a 10% penalty. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Click next to pay your personal property and real estate taxes in madison county, arkansas. Search tax records / receipts.. Madison County Arkansas Personal Property Tax.

From diaocthongthai.com

Map of Madison County, Arkansas Madison County Arkansas Personal Property Tax Online payments are available for. The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. Assess your personal and business property between january 1st and may 31st of each year to avoid a 10% penalty. The collector's office is responsible for collecting real estate and personal property taxes on all property. Madison County Arkansas Personal Property Tax.

From www.whereig.com

Map of Madison County, Arkansas Where is Located, Cities, Population Madison County Arkansas Personal Property Tax The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Assess your personal and business property between january 1st and may 31st of each year to avoid a 10% penalty. Taxes on real estate and tangible personal property are ad valorem. Click next to pay your personal property and real. Madison County Arkansas Personal Property Tax.

From www.mappingsolutionsgis.com

Madsion County Arkansas 2020 Aerial Wall Map Mapping Solutions Madison County Arkansas Personal Property Tax The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Click next to pay your personal property and real estate taxes in madison county, arkansas. Search arkansas assessor and collector records online from the comfort of your home. Online payments are available for. Taxes on real estate and tangible personal. Madison County Arkansas Personal Property Tax.

From www.land.com

10 acres in Madison County, Arkansas Madison County Arkansas Personal Property Tax Taxes on real estate and tangible personal property are ad valorem. Click next to pay your personal property and real estate taxes in madison county, arkansas. The collector in this county has sponsored a free to. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Search arkansas assessor and. Madison County Arkansas Personal Property Tax.

From www.wbbjtv.com

Pay property tax in Jackson or Madison Co.? We want to hear from you Madison County Arkansas Personal Property Tax Taxes on real estate and tangible personal property are ad valorem. Pay madison county taxes online. The collector in this county has sponsored a free to. Search arkansas assessor and collector records online from the comfort of your home. The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. Search tax. Madison County Arkansas Personal Property Tax.

From www.landwatch.com

Witter, Madison County, AR House for sale Property ID 336351809 Madison County Arkansas Personal Property Tax Taxes on real estate and tangible personal property are ad valorem. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Click next to pay your personal property and real estate taxes in madison county, arkansas. Pay madison county taxes online. Search arkansas assessor and collector records online from the. Madison County Arkansas Personal Property Tax.

From www.mapsales.com

Madison County, AR Wall Map Color Cast Style by MarketMAPS Madison County Arkansas Personal Property Tax The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. Pay madison county taxes online. The collector's office is responsible for collecting real estate and personal property taxes on all property assessed in madison county. Click next to pay your personal property and real estate taxes in madison county, arkansas. Assess. Madison County Arkansas Personal Property Tax.

From www.countryaah.com

Cities and Towns in Madison County, Arkansas Madison County Arkansas Personal Property Tax Pay madison county taxes online. Taxes on real estate and tangible personal property are ad valorem. Search arkansas assessor and collector records online from the comfort of your home. The madison county assessor office, led by christal ogden, is responsible for assessing personal and business property within madison. The collector's office is responsible for collecting real estate and personal property. Madison County Arkansas Personal Property Tax.